New technologies generate many opportunities, but they also catalyze challenges. As the digital age brings changes to everyday life, the insurance industry must also respond with progression. This year, University of Illinois at Urbana Champaign’s Actuarial Science Club and Illinois Risk Lab are joining forces to bring together leaders from both the academic community and the insurance world at this year’s Risk Analytics Symposium 2021: Actuarial Innovations to Emerging Risks.

The symposium will be an all-day virtual event that aims to enlighten students and professionals interested in risk analysis and predictive analytics about trends within the actuarial profession. Insightful presentations from experts in the field will cover topics related to solving emerging risks across the insurance industry and how using innovative methods, including InsureTech, AI, and data analytics, are utilized in the process.

Networking opportunities will be available to connect you with the leaders and future leaders of the actuarial field. After each speaker topic, our experts will answer audience questions in a guided dialogue, and a formal networking session will be open to all attendees following the speaker series. Additionally, this forum will showcase the most recent research of the Illinois Risk Lab and accomplishments of the Actuarial Science Club in the virtual environment.

If you are interested in learning more about emerging trends in actuarial science, data science, and InsureTech from actuarial leaders and building professional relationships at our virtual networking session, then this is the event to attend!

Meet Our Speakers:

Speaker: Katrien Antonio

Institution: Katholieke Universiteit Leuven

Topic: Boosting Insights in Insurance Tariff Plans with Machine Learning Methods

As machine learning has increasingly become important in today’s technological world, actuaries are now using it to help boost insight in insurance tariff plans. Katrien Antonio, professor at Katholieke Universiteit Leuven, will discuss the latest research on developing tariff plans using machine learning methods. She will explore key aspects of machine learning, and the overall approach her team has chosen to gain optimal insight on evaluating tariff plans.

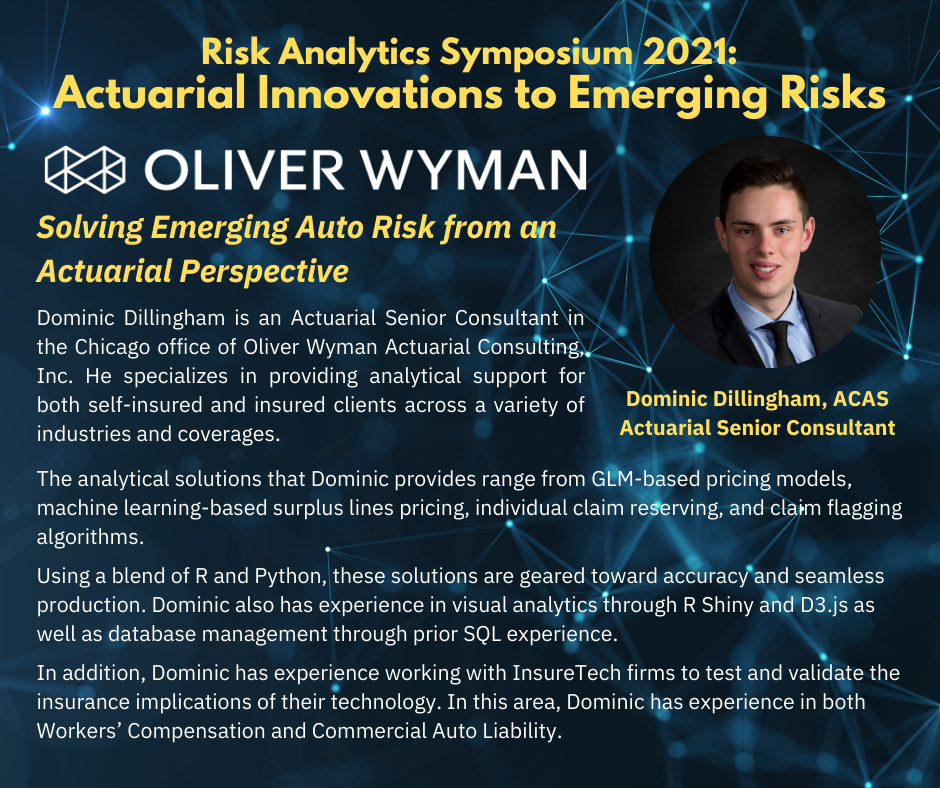

Speaker: Dominic Dillingham

Company: Oliver Wyman

Topic: Vehicle Safety Technology in Risk Management

Using analytical and technological expertise, actuaries help provide auto companies with safe and innovative solutions for their customers. Dominic Dillingham, a senior consultant from Oliver Wyman will identify and assess emerging auto risks from an actuarial perspective and discuss the development of vehicle safety technology, which promises to reduce potential threats within the automotive industry.

Speaker: Margie Rosenberg

Institution: University of Wisconsin-Madison

Topic: A Clustering Approach using Social Determinants to Identify Profiles of US Children and their Families with Low Dental Expenditures and High Medical Expenditures

Actuarial expertise and the application of statistical methods are used to analyze cost and policy issues in healthcare. Using an unsupervised clustering method, Margie Rosenberg, the Assurant Health Professor at the University of Wisconsin-Madison, researches social determinants to identify groups of individuals with low dental expenditures and high medical expenditures. She will share the preliminary results of her study and the importance of her research on long-term overall health in adults.

Speaker: Jeff Myers

Company: Reinsurance Group of America

Topic: Wearable Technology in Insurance

Data is more available than ever before, and actuaries are embracing the challenge and opportunity that wearable technology presents for the insurance industry. Jeff Myers, Executive Director for the Decision Science section of RGA's Global Data and Analytics team, will demonstrate how insurers can utilize wearable technology to understand consumer’s health habits and create products that best fit customer needs.

Speaker: Quanyan Zhu

Institution: New York University

Topic: Cyber Risks and Their Mitigation Strategies

For the past few years, we have witnessed cyber incidents that have created many social concerns and economic impacts. Quanyan Zhu, an associate professor at the New York University Department of Electrical and Computer Engineering, will present the game-theoretic frameworks that allow us to incorporate the reasoning of cyber attackers into the risk assessment of our own networks. His discussion will show several solutions to address these issues, such as proactive cyber defense, resiliency, and insurance.

Speaker: Dominic Keller

Company: Willis Towers Watson

Topic: Cyber Risk Management Strategies

As data becomes increasingly widespread in today’s modern environment, cyber risks are rapidly evolving and are a strategic challenge capturing the attention of the leaders of the insurance world. Dominic Keller, Global Team Leader and Senior Consultant at Willis Towers Watson, will discuss how scenario based cyber risk quantification allows organizations to understand the unique financial loss potential posed by cyber risks. He will explore key considerations for quantifying cyber risk and approaches to mitigate cyber risk.