Resume Book

For Actuarial Science Club members that have paid their dues, we are showcasing our student talent by compiling a resume book for some of our guest speakers. This will be sent to them prior to the day of the event, as some of them are interested in recruiting. If you did not pay dues in the fall and would like to be featured in the resume book, dues for this semester are $12.50. You can Venmo UIUC_ASC with your name, NetID, and "dues" in the caption or pay your dues in cash at Cube Hours (RSO Complex, Cube 10). Deadline is Wednesday, March 27th 8pm.

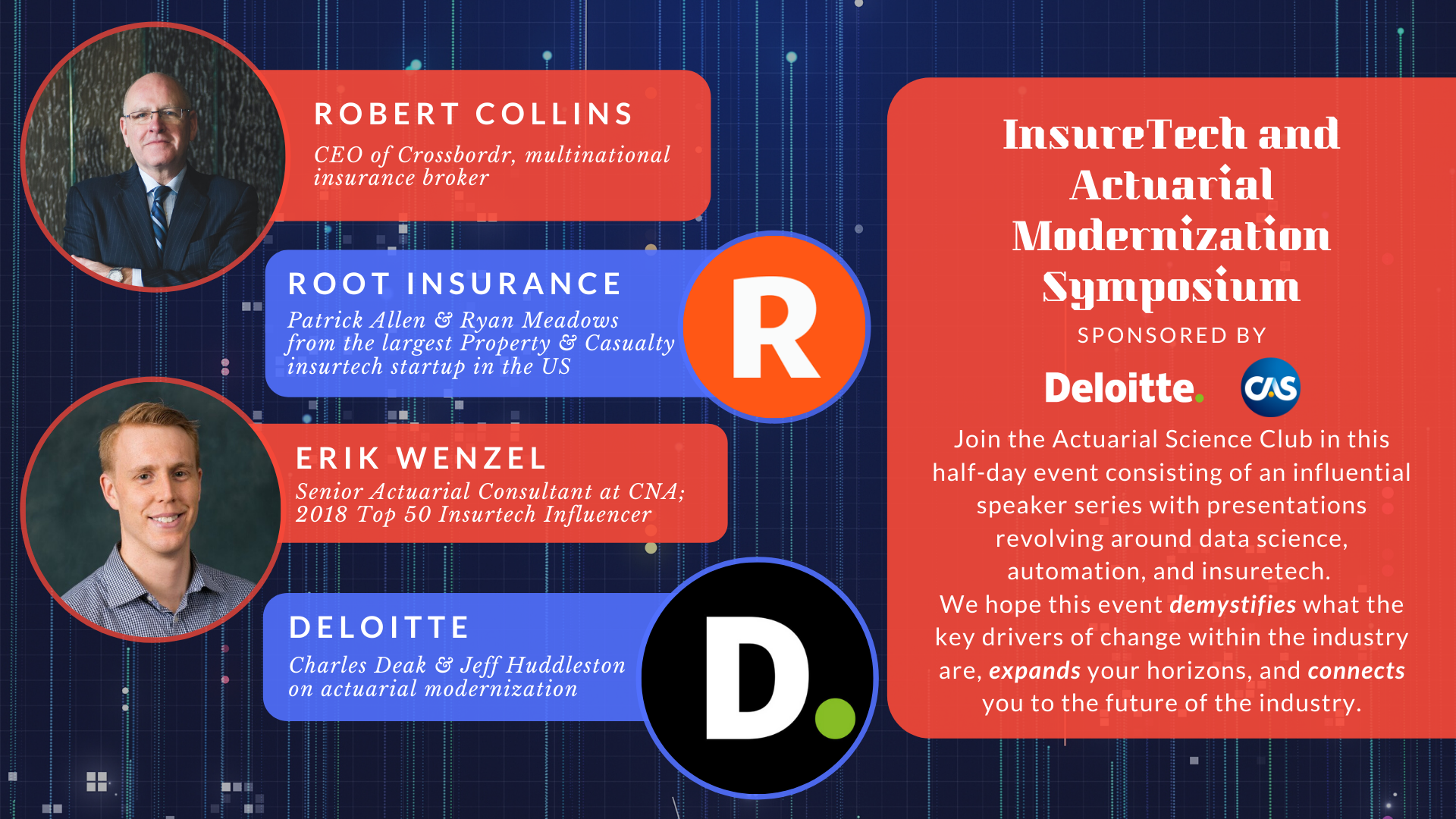

Meet Our Speakers

Erik Wenzel, FSA

Erik is a true actuarial geek and insurtech enthusiast whose mission to inspire actuaries to embrace the opportunities of the data and insurtech revolutions. Erik writes frequently on topics related to insurtech, data science, and actuarial science, and the cross-section between the three. He was named an insurtechnews.com top 50 insurtech influencer in February of 2018 and is currently on the Society of Actuaries Insurtech Task Force. Erik’s LinkedIn posts have received millions of views and thousands of likes, and have sparked a global conversation on the future of the actuarial profession.

Erik is an FSA with 8 years of experience in life, annuities, and long term care. He currently works as a long term care experience studies at CNA Insurance in Chicago.

Speech Topic: Actuaries and the Inevitable: 4 Ways Actuaries can Secure their Future in a World of Hyperconnectivity, AI, and Insurtech

Robert Collins

Rob is a global consultant specialized in cross-border advisory services, business development and scale-up for insurance technology (insurtech) startups and early-stage companies.

He is the CEO of Crossbordr®, a U.S. based insurance broking firm focused on developing international insurtech opportunities. Rob’s clients range from the world’s first online insurance company to biometric IoT driven startup in the healthcare space to a community-based mutual insurance platform.

He lived and worked in Asia for 20+ years with insurance P&L accountability across 14 countries. Rob has a deep understanding of the China business system having resided in Beijing, Shanghai, and Hong Kong. He was a Managing Director at Aon Corporation and a Director with Capgemini’s Global Insurance Consulting practice with a strong focus on developing opportunities in emerging markets.

He has a joint MBA from the Kellogg School of Management, Northwestern University, and The Hong Kong University of Science & Technology. He is an adjunct professor at Hult International Business School.

Rob is a mentor at Ping An Accelerator in Shenzhen, China, member of the MIT Technology Review Global Panel, and a speaker at the world’s foremost insurtech industry conferences. He is the author of Doing Business in China for Dummies (Wiley Publishing, 2007); and “Growth Waves for Insurtech in China”, The InsurTech Book (Wiley Publishing, 2018).

Greg Meyer

Kin Insurance is an insurtech startup revolutionizing the homeowner’s insurance industry. Kin’s streamlined online platform relies on automation and data science to find and provide the best overall homeowner’s policies for their customers. By leveraging insurtech instead of traditional business methods, homeowners are now able to get their homes insured faster, cheaper, and easier than ever before! Learn more about this Chicago-based insurtech powerhouse from its Chief Insurance Officer, University of Illinois Alum Greg Meyer.

Patrick Allen and Ryan Meadows from Root Insurance

Patrick Allen works in Reserving at Root Insurance. He has worked in various roles at Zurich Insurance and National General prior to joining Root, including Reserving, Data Visualization, and Competitive Analytics.

Ryan Meadows is a Senior Actuarial Analyst at Root Insurance Co. and holds a Bachelor of Science in Mathematics from The Ohio State University. His work at Root thus far has been focused in Pricing, Competetive Analytics, and Underwriting. He is an avid problem solver who is thrilled to be using data science and machine learning techniques in an actuarial context.

Charles Deak and Jeff Huddleston from Deloitte

Charles and Jeff are both managers in the life insurance consulting practice at Deloitte.

Charles focuses on Actuarial Modernization and is a part of Deloitte’s Actuarial Modeling Team. He has assisted companies with improving their systems and processes to increase the effectiveness of the actuarial function. Charles also provides modeling solutions for a variety of life insurance and annuity products. He has served on various system conversion teams as a lead builder and tester. Charles also has experience with assessing system architecture, implementing model governance, and recommending best practices.

In addition to client work, Charles is part of the Model Risk Governance Specialty Group within the SOA Modeling Section.

Jeff's focus at Deloitte has been in life insurance company operations, with a specific interest in helping clients understand how the strategic application of predictive models can improve operations throughout their organizations.

His other areas of interest are life and annuity product development and pricing, risk and capital management, actuarial modeling, actuarial valuation and financial reporting, and marketing and distribution of insurance and annuity products.

In addition to being an Associate of the Society of Actuaries (ASA), he also holds the Chartered Enterprise Risk Analyst (CERA) credential from the Society of Actuaries.

Thank you to the Symposium Committee and speakers for supporting our first ASC Symposium!

Left to right: Yi Yuan, Carrie Wang, Titan Wibowo, Robert Collins, Sung Yeo, Erik Wenzel, Charles Deak, Jeff Huddleston, Kara Wong, Patrick Allen, and Ryan Meadows.